Page 598 - scvhs19801989minutes

P. 598

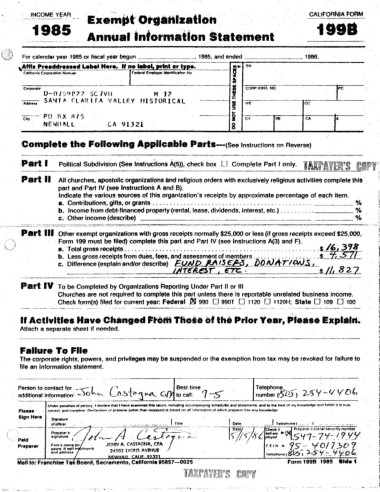

INCOME YEAR CAL1FORNIA FOFlM

Exemjtt•· Or1•11lzatlon

1985 1998

Annual information Statement

For calendar year 1985 or fiscal year begun _______ , 1985, and ended _______ , 1986.

Affix Pre• ddreHed Label Here. ff no label. IIH'lnt or ti,~_•_ a· SN

-~-·

C11li!ornlA Corport1llt'.!n Nom,..., I red9f11t Employer !<Mntlflc•llori No

Corporao.- ! PC

• CORP.IORO NO.

o-o,sqe;,;, SC 7VH M J? ~

-- SANT II CLAR J.TA V f\Llf:Y tflSTORICAL

I

Addr4'59 !YE cc

--- PO BX ll75 i

Ctty CY CA A

NEHll~Ll CA 91321 8

'OE

Complete the Followlng AppHcable PartS-(See Instructions on Reverse)

Part I Political Subdivision (See lnstrucilons A(5)), check box LJ Complete Part I only. 1f U~~W~!Rt$ ©@lp)1f

Part II All churches, apostolic organizations and religious orders with exclusively religious activities complete this

part and Part IV (see Instructions A and B).

Indicate the various sources of this organization's receipts by approximate percentage of each item.

a. Contributions, gifts, or grants .............................................. _____ %

b. Income from debt-financed property (rental, lease, dividends, interest, etc.) .......... _____ %

c. Other income {describe) __________________________ %

Part Ill Other exempt organizations with gross receipts normally $25,000 or less (if gross receipts exceed $25,000,

Form 199 must be filed) complete this part and Part IV (see Instructions A(3) and F). _. J/

a. Total gross receipts ...... : ............ • • • • • • • • • • • · · · · · · · · · · · · · · · · · · · · · · · · · · $ /Jt,¾777

b. Less gross receipts from dues, fees, and assessment of members ................... $_o/i~-~-~--

c. Difference (explain and/or describe) FUAJ D _M. I j E"/J-a ,_D_O IV Ii TI ON~-

_______ ·_. _-~'--"~ri~'E"i~"-~r, n:r. . $JI, 8 2-7

Part IV To be Completed by Organizations Reporting Under Part II or Ill

Churches are not required to complete this part unless there is reportable unrelated business income.

Check form(s) filed for current year: Federal /8 990 [] 990T D 1120 D 1120H; State D 109 D 100

----------·----------··---------.

I,

If Activities Have Changed r:toffl Tlloie of thi Prior Year, Pl•••• lxplaln~

Attach a separate sheet if needed.

---------·-~------·- ------------------------------

Fallure To FIie

The corporate rights, powers, and privileges may be suspended or the exemption from tax may be revoked for falfure to

file an Information statement.

Person to contact for _ ~ I /-, _ · _ J Best time Telephone _ b

additional Information: ..... ) O "'-'-' ~ fc'I-- to call: 1 -,_'5": number (OD5) UY -1./ VD

Undt>r penallle• or perjury. r declare Iha! I ha"" ewamln9d 1h19 return. Including accompanying schedult• and Slalements, and to the h,.st of my knowl<'dq~ anr! ""lief ii ts '"'"·

Please cnrtfl'Cf. 11nd compffll'ltt o,-d:tr:ttion of. prftJ'NI'"' (ofh" than t111s,eye,r) l!I b.1!';@d on Alt inform~lion of which prepl'IH"' h:1~ Any hnowterlqn

Sign Here

:;:;,::" . . _ _ _______ . ... I Tlffe

.,,,. -·-·--:- .. -; c·-, .. .

Preparer·• / _/ · /1 / . - 7--~~. -

Paid. 9ignalore ( ·- _. t/"( ..,_,_.. /-:J . _ L-<(-~7 1, - ,,-, .... ·.

Preparer Firm·• nsme 10, JOflN A. CASTAGNA, CPA

yours. If self" r•nvP<il 24 ~02 LYONS AV!NUE .

and address -

Mall to: Franchise T Form t 99B 1985 Side t